ESG Is a Green Façade for Corporations. Let’s Design an Open-Source Rating That Measures Real Impact

In the world of IT and business, we’re used to measuring everything: performance, conversion, uptime. But how do you measure a company’s real impact on the world? The acronym ESG (Environmental, Social, Governance) tries to answer this question. The idea is noble — to evaluate a business not just on its profits, but on its contribution to the environment, society, and quality of governance.

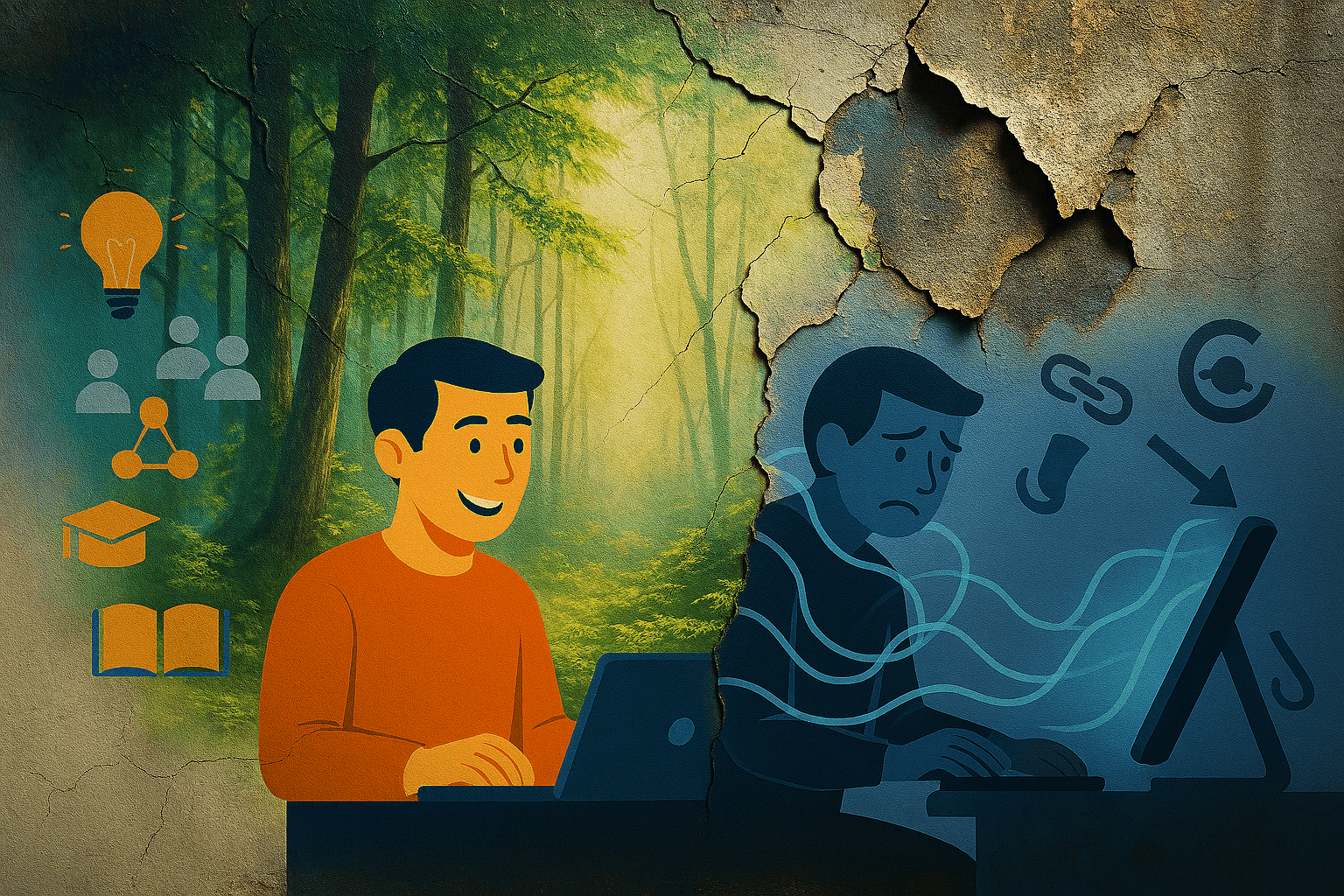

The problem is that ESG has turned from a tool into a marketing weapon. Companies spend millions on glossy reports that often hide the true state of affairs. This phenomenon is known as “greenwashing.”

In this article, I propose we deconstruct the existing approaches and outline a concept for an alternative, open-source rating system, which we at our project, Civethica, call a systemic ethical rating. The goal is to measure real systemic contribution, not just words.

1. Analyzing Existing Ratings (ESG and Similar): Why the Compass Is Broken

The market is dominated by a few major players: MSCI, Sustainalytics, Bloomberg ESG. Their methodologies generally boil down to a few key approaches:

- Non-Financial Reporting Analysis: Companies fill out surveys and provide sustainability reports themselves.

- Internal Policy Assessment: The rating checks if a company has policies for reducing emissions, promoting gender equality, or fighting corruption.

- Media Monitoring: Algorithms track company mentions in the media to identify scandals.

It sounds good on paper, but in practice, this system creates several fundamental flaws.

2. System Flaws: Greenwashing, Black Boxes, and Conflicts of Interest

The Engine of Greenwashing. When an assessment depends on self-reporting, the winner isn’t the one who genuinely cares about the planet, but the one with the better PR department. A company can cut down forests in one country while simultaneously getting top marks for planting trees in a park near its headquarters.

Lack of Transparency (The “Black Box”). For most agencies, the rating methodologies are a trade secret. It’s impossible to understand why one company received an “A” rating while another got a “B.” For the IT community, which values openness, this is nonsense.

Conflict of Interest. Rating agencies often receive payment from the very companies they evaluate. This creates obvious pressure to assign ratings that won’t scare off the client.

The “Good vs. Bad” Paradox. Existing systems don’t evaluate the core of the business. A tobacco company can achieve a high ESG rating through efficient cigarette butt recycling and an inclusive hiring policy. But its core product continues to kill people. The system evaluates how something is done but ignores what is being done.

3. The Need for Ethical Standards: From Processes to Systemic Contribution

To fix this, we need to shift our focus from a company’s internal processes to its external systemic contribution. It’s not about how many beautiful policies are written, but whether the company’s activities have made the world healthier, more stable, and cleaner.

We propose evaluating businesses based on two key cycles:

- The Value Creation Cycle: What does the company produce, and how? Does its product bring benefit or harm? What are the environmental and social costs of its production?

- The Value Distribution Cycle: Where do the company’s profits and influence go? Does it fund political parties that incite conflict? Does it use offshore accounts to avoid taxes? Does it engage in information warfare?

This fundamentally changes the approach: a producer of organic yogurt that sponsors disinformation campaigns would receive a deeply negative rating in our system.

4. Where to Get the Data? A Data Collection Architecture

From a technical standpoint, this is the most challenging and interesting question. Information for such a rating must come from a multitude of open and alternative sources. Our concept involves creating an aggregator system that works with the following data types:

- Public Data: Financial reports (e.g., SEC filings), corporate press releases, and official sustainability reports. These are important but must be analyzed with a critical eye for bias.

- Alternative Data (Alt-data):

- Media Analysis: Parsing news outlets from around the world, using NLP models to analyze the sentiment of publications to identify scandals and positive initiatives.

- NGO and Activist Reports: Data from organizations like Amnesty International, Greenpeace, and Human Rights Watch on human rights violations, environmental damage, etc.

- Government and Legal Databases: Lobbyist registries (like OpenSecrets in the U.S.), court cases, tax data (where available), and sanction lists.

- Geospatial Data: Analyzing satellite imagery to track deforestation, oil spills, or industrial emissions (projects like Climate TRACE).

- Crowdsourcing: Community-verified information from employees, local residents, and experts (using a model similar to Wikipedia, with strict moderation and fact-checking).

5. How to Implement It? The Assessment Mechanism and Open Source

A simple A-to-F scale won’t work here. The system must be multidimensional.

- Weighted Coefficients: The most difficult task is to determine the weight of each criterion. How do you compare a ton of CO₂ emissions with one instance of child labor? This model must be the subject of open scientific and public debate.

- Separating Positive and Negative Contributions: A company can do good and bad things simultaneously. Therefore, it’s logical to have two independent scores: a Creation Index and a Destruction Index. This provides a more honest picture.

- Full Openness (Open Source): The entire methodology, scoring algorithms, parsers, and source code should be published on GitHub. Anyone should be able to verify a rating or suggest an improvement.

6. The Expected Effect: From Manipulation to Conscious Choice

Implementing such a transparent and systemic rating could trigger a chain reaction:

- Investors will gain a tool for genuine impact investing, not just for buying indulgences.

- Consumers will be able to make choices based on real values, not just marketing.

- Employees (especially in IT) will be able to choose employers whose missions align with their conscience.

- Companies will receive honest feedback and a roadmap for real improvement, not just for writing another report.

Conclusion

The existing economic evaluation system is obsolete. It encourages the simulation of responsibility instead of responsibility itself. We believe that creating an open, honest, and systemic evaluation tool is a challenge worthy of the IT community.